Explore and Trade 400+ Cryptocurrencies

Buy, sell, swap, track, and analyse hundreds of cryptocurrencies on an Australian owned and operated crypto exchange.

Gain a Competitive Edge

Our advanced trading platform monitors global crypto markets to ensure you get the best possible price.

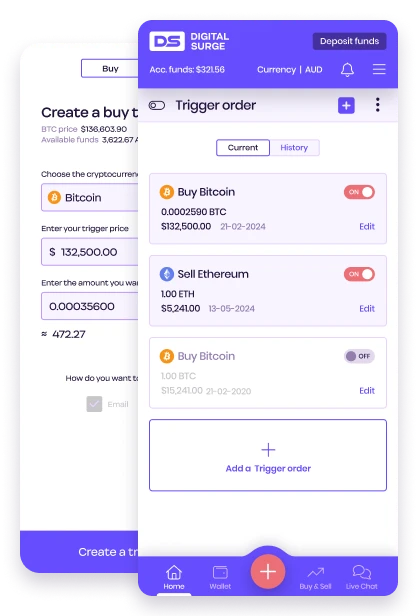

Plan your orders and take control of the market

Trigger orders are a powerful trading tool that allows you to automate buy or sell orders based on specific price conditions.

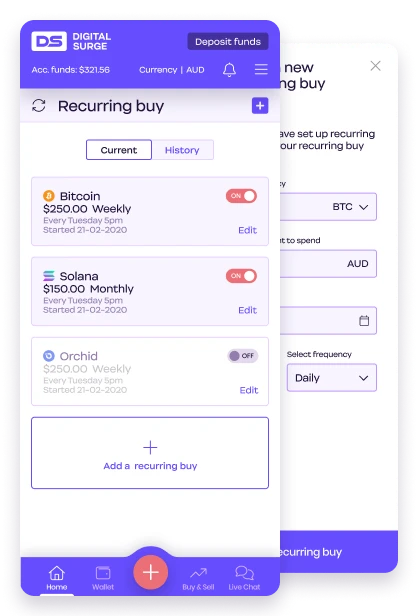

Automate your trades and get the most from Dollar Cost Averaging

Recurring buys automate your crypto purchases, leveraging Dollar Cost Averaging (DCA) to help you consistently build your portfolio and reduce the impact of market volatility.

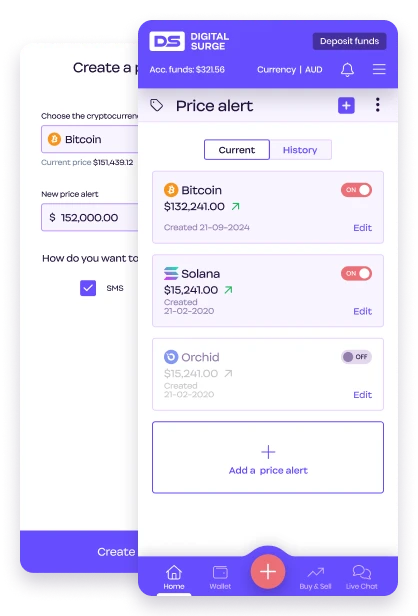

Get notified automatically when prices change

Price alerts keep you updated by automatically notifying you when your chosen crypto hits your desired price.

Access Competitive Global Prices

We trade across global crypto markets, allowing you to benefit from competitive pricing on every trade.

Access a Wide Range of Coins

We offer a diverse selection of cryptocurrencies, giving you more options to trade and manage your assets.

Protect Your Assets with Advanced Security

We prioritise your safety with robust security measures, ensuring your assets are well-protected at all times.

Loved by 50,000+ customers. Trusted with over $1.7B traded.

Your assets are well protected

Our risk management measures are designed to protect your assets. We have integrated with Fireblocks to enhance our custodial security.

The freedom of crypto for everyone, everywhere

We’re committed to creating more economic freedom through accessible, safe, and secure financial tools for everyone.