Did you know that over 6.2 million Australian adults own or have previously owned crypto or digital assets? That’s about 32% of the adult population in Australia embracing digital assets, not just as speculative purchases but as practical tools for financial empowerment. If you’ve been wondering whether it’s time to hop on this digital bandwagon, you’re in good company. Crypto isn’t the future anymore—it’s happening now, and Australians are leading the charge.

Whenever something new comes along, there’s bound to be uncertainty. The headlines often highlight scams or hacks, painting a picture of cryptocurrency as risky or unsafe. However, these stories typically overlook the millions of Australians who securely and confidently store and trade their Bitcoin every single day. Just like Internet banking once seemed intimidating but quickly became second nature, safely handling cryptocurrency is straightforward once you know the basics.

Think of storing Bitcoin safely as locking your door when you leave the house—a simple habit that keeps your belongings secure. You’ll easily safeguard your digital assets, sidestepping scams or mishaps with a few simple steps. Together, we’ll walk through exactly how to secure your Bitcoin, giving you peace of mind so you can truly enjoy being part of Australia’s thriving crypto community.

Ready to discover how easy it is to keep your Bitcoin safe and secure? Let’s dive into exactly what you need to know.

Crypto is Safe – When Done Right

The idea that crypto is only for tech wizards or risk-takers is quickly becoming outdated. Ownership among Aussies aged 25–34 is now at 53%, reflecting a new generation of digitally savvy Australians treating crypto as a regular part of their financial lives.

Still, some hesitations linger—usually around security. The good news? Staying safe in crypto doesn’t require advanced technical skills. It just means making informed choices about how and where you store your assets.

Think of your crypto wallet like your everyday bank account. Just as you’d choose a trusted institution to manage your money, you should choose secure platforms and wallets to manage your Bitcoin. Exchanges like Digital Surge, for example, combine bank-level encryption with Australian regulatory compliance to help users store and access their crypto securely.

So, rather than being intimidated, it’s time to feel empowered. By understanding where and how your Bitcoin is stored, you’ll control your digital assets and be ready to trade, hold, or grow your portfolio.

Next, let’s demystify Bitcoin storage. Where does your Bitcoin live, and how can you protect it?

Understanding Bitcoin Storage: Easy and Safe

If you’ve ever wondered, “Where is my Bitcoin actually stored?”—you’re not alone. It’s one of the most common questions new crypto traders ask. The good news? The answer is simpler than you might think.

Let’s break it down.

When you own Bitcoin, you don’t physically hold a coin or file somewhere on your device. You own a set of keys—a public key (like your account number) and a private key (like your password). These keys give you access to your Bitcoin, which is stored securely on a global network called the blockchain.

The blockchain isn’t a mysterious cloud—it’s a decentralised ledger that records every Bitcoin transaction ever made. Your Bitcoin doesn’t move around in the traditional sense; it stays on the blockchain. Your private key simply gives you permission to access and move it.

Here’s a quick way to think about it:

Your wallet doesn’t hold Bitcoin—it holds the keys to unlock it.

Just like your email app doesn’t store your emails—it just lets you access them.

So, what’s the safest way to store those keys? That’s where wallets come in. Whether it’s a mobile app, a USB-style hardware wallet, or a secure online platform like Digital Surge, the wallet you choose is really a key management tool.

Let’s recap:

Where are Bitcoins stored?

Bitcoins are stored on the blockchain. Wallets manage the private keys that give you access to them.

Wallet Choices Made Simple: Which Is Best for You?

The type of wallet you choose depends on how you plan to use your Bitcoin. Think of it like choosing between a regular wallet you carry around or a safe you keep tucked away at home—each has its place depending on your needs.

Let’s break it down.

Convenient Hot Wallets

Hot wallets are perfect for everyday use because they are connected to the internet, so you can buy, trade, or send Bitcoin in just a few taps. They’re typically apps or web-based wallets that let you access your crypto on the go.

If you like to check your portfolio while waiting for your morning coffee or make quick trades, a hot wallet might be your go-to.

To use a hot wallet safely:

- Always enable two-factor authentication (2FA)—it’s like adding an extra lock on your digital door.

- Use a strong, unique password and don’t reuse it across accounts.

- Stick with trusted platforms—like Digital Surge—that prioritise security and comply with Australian regulations.

Ultra-Secure Cold Wallets

Cold wallets, on the other hand, are offline. That means they’re not exposed to the internet, making them incredibly secure—ideal for holding larger amounts of Bitcoin over the long term.

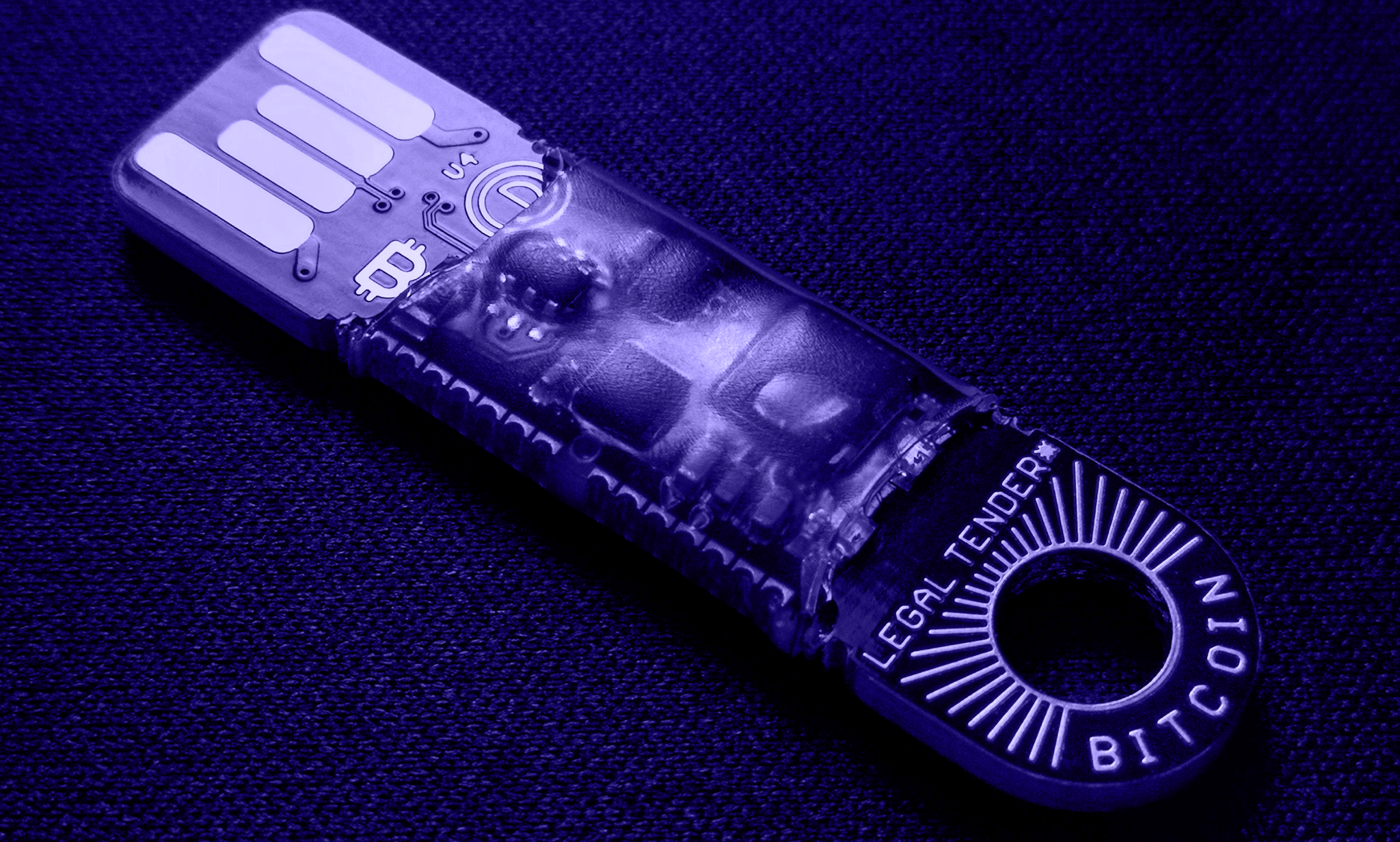

Most cold wallets are hardware devices (they look like USB sticks) designed to store private keys offline.

Getting started is easier than it sounds:

- Purchase a reputable hardware wallet like the Ledger Nano X or Trezor.

- Follow the setup instructions carefully, including writing down your seed phrase and storing it in a safe place (not on your phone).

- Transfer your Bitcoin from your exchange (like Digital Surge) to the wallet’s address.

Bonus tip: Some traders use both wallet types—keeping a small amount of crypto in a hot wallet for everyday use and the rest in cold storage for peace of mind.

If you’re using Digital Surge, we’ve simplified the wallet experience. Our integrated wallets offer the convenience of hot storage with extra layers of security, including cold storage for the bulk of users’ funds, so you get the best of both worlds.

Step-by-Step: Safely Set Up Your Bitcoin Wallet

Setting up a Bitcoin wallet doesn’t need to be complicated. Whether you’re planning to trade regularly or hold for the long haul, having the right setup makes all the difference in protecting your crypto and feeling confident as you do it.

1. Choose the Right Wallet for You

First, think about how you plan to use your Bitcoin. Like many other Aussies, you may want to use a combination of a hot and cold wallet.

If you’re just starting out, Digital Surge’s integrated wallet is a great first step—it’s beginner-friendly, secure, and automatically stores most funds in cold storage.

2. Set Up and Secure Your Wallet

Once you’ve picked your wallet type, it’s time to set it up safely.

For software (hot) wallets:

- Download from an official source—never third-party sites.

- Set a strong, unique password.

- Turn on two-factor authentication (2FA) for extra security.

For hardware (cold) wallets:

- Buy directly from the manufacturer or an authorised reseller.

- Write down your seed phrase (usually 12 or 24 words) and keep it in a secure, offline place.

- Never take a photo of your seed phrase or store it in your email or cloud storage.

Avoid this mistake: Don’t share your private keys or seed phrase with anyone. If someone else has it, they have complete control over your Bitcoin.

3. Transfer Your Bitcoin Safely

Once your wallet is ready, it’s time to transfer your Bitcoin from your exchange to your wallet.

How to transfer Bitcoin safely:

- Log in to your Digital Surge account.

- Go to your Bitcoin wallet and click “Withdraw.”

- Enter your new wallet’s Bitcoin address carefully (double-check it—it can’t be undone).

- Confirm the amount and complete any security checks (like 2FA).

- Wait for the network confirmation—this usually takes a few minutes.

Once done, your Bitcoin will arrive in your wallet, safe and secure under your control.

Keen to learn more about Bitcoin? Check out our blog What is a Bitcoin halving?

Keeping Your Bitcoin Secure – Best Practices Everyone Can Follow

Once your wallet is set up and your Bitcoin is in your hands, the next step is to keep it that way. Security in crypto isn’t about being paranoid—it’s about building smart, simple habits that protect what’s yours.

Here are the most effective ways to stay safe:

1. Keep Your Wallet Up to Date

Updates matter whether you use a mobile app, desktop wallet, or hardware device. Developers regularly release patches that fix vulnerabilities or improve security.

If your wallet prompts you to update, don’t delay. Like your phone or computer, outdated software can be an easy target.

Action step: Turn on auto-updates where possible—or set a monthly reminder to check manually.

2. Use Two-Factor Authentication (2FA)

Think of 2FA as adding a deadbolt to your digital front door. It’s one of the easiest and most effective ways to stop unauthorised access.

When you enable 2FA (available through apps like Google Authenticator or Authy), you must confirm logins with a one-time code on your device, even if someone has your password.

On platforms like Digital Surge, 2FA is strongly encouraged and only takes a few minutes to set up. It’s a small effort for a big security win.

3. Watch Out for Lookalikes

Crypto scams often involve impersonation—fake websites, phishing emails, or apps that look almost identical to the real thing.

Before logging in, always double-check the URL. Bookmark trusted sites, and never click suspicious links sent via email or social media.

If you’re using an exchange, choose one that prioritises security and transparency. At Digital Surge, we’ve seen firsthand how simple safeguards can give users the confidence to trade and store their Bitcoin without stress.

One user recently shared:

“Initially, I had no idea about cryptocurrency, but a quick Google search put Digital Surge as a recommended Australian app. I gave it a go, and after four months, I thought I would see what other apps were like. But within a week, I was back using Digital Surge because it has, hands down, the best interface and function.

Super user-friendly and fast. I had a transfer issue the other day, and they have a customer live chat function that saw an immediate response from an actual human staff member. They fixed my problem, which was very complex, in a timely manner and were open and honest the entire time. I am convinced Digital Surge is the best platform for your crypto needs and is incredibly trustworthy. You won’t regret it.” – Hayden, Google Review

These kinds of small, steady practices make a big difference over time. Like brushing your teeth or locking your car, you won’t think twice once it’s a habit.

Next, let’s look at a few common mistakes traders make—and how you can avoid them.

Common Pitfalls Easily Avoided

When storing Bitcoin, most issues don’t come from complicated hacks or advanced threats—they come from simple mistakes. The good news? These are easy to avoid with a bit of know-how and the right tools.

Here are a few of the most common missteps—and how to steer clear of them:

Mistake #1: Storing Everything in One Place

Keeping all your Bitcoin in a single hot wallet—especially one connected to the internet—can expose you to unnecessary risk. It’s like carrying all your cash around in your pocket every day.

What to do instead:

Split your holdings. Use a secure exchange wallet like Digital Surge for everyday access and a hardware wallet for long-term storage.

Mistake #2: Ignoring Backups

If you lose your private keys or seed phrase, there’s no password reset button. Without a backup, your Bitcoin could be gone for good.

What to do instead:

Back up your seed phrase and store it offline in multiple secure locations, such as a locked drawer or safe, not on your phone or online drive.

Mistake #3: Falling for Impersonators

Fake support teams, scam emails, dodgy download links—scammers are clever but predictable.

What to do instead:

Only use official platforms and communication channels. Digital Surge users benefit from verified support, local guidance, and proactive alerts to help our users prevent scams.

At Digital Surge, we build safety into everything, so you don’t need to be a cybersecurity expert to stay protected. From layered security infrastructure to a dashboard highlighting best practices, our platform is designed to keep traders informed without overwhelming them.

Simple habits. Smart choices. That’s all it takes to stay ahead.

Next, let’s look at what it takes to sell or trade Bitcoin safely, especially if you’re using an Australian exchange.

Trading and Selling Bitcoin Safely

Once you’ve built up some Bitcoin, you might want to convert it into Aussie dollars—whether to cash out profits, cover expenses, or rebalance your portfolio. Whatever the reason, it’s essential to sell Bitcoin through a platform that makes the process safe, smooth, and transparent.

Digital Surge is built for exactly that.

As a fully regulated Australian exchange, Digital Surge gives you a simple, secure way to sell Bitcoin in Australia with confidence. You can withdraw funds directly into your Australian bank account—usually within minutes—without dealing with overseas platforms or confusing interfaces.

The entire process happens in three easy steps:

- Log in to your account

- Navigate to your Bitcoin wallet and choose “Sell”

- Select the amount you want to convert to AUD, confirm, and you’re done

Because Digital Surge operates locally, you’re trading under Australian consumer protections, with clear fee transparency and no hidden costs.

What About Tax?

Selling Bitcoin in Australia may trigger a Capital Gains Tax (CGT) event. That doesn’t mean it’s complicated—it just means it’s worth staying informed.

Here’s a quick overview:

- If you sell Bitcoin for more than you paid, you may need to report the profit on your tax return.

- If you have held Bitcoin for over 12 months, you might be eligible for a 50% CGT discount.

- The ATO treats crypto like property—not currency—so record-keeping matters.

Don’t stress, though. Digital Surge makes tax time easier by providing transaction history reports you can download and share with your accountant or plug into crypto tax software.

Next, we’ll wrap up with key takeaways and an easy call to action for staying safe and confident on your crypto journey.

Take Control of Your Crypto, Securely

Storing Bitcoin safely doesn’t have to be complicated. With the right wallet, smart habits, and a trusted platform, you can protect your digital assets like millions of other Australians.

From understanding how wallets work to choosing between hot and cold storage, backing up your keys, and trading securely, you’re now equipped with the knowledge to manage your Bitcoin confidently.

Crypto is here to stay, and more Australians are joining the digital economy every day. By making informed choices, you’re not just keeping your assets safe—you’re joining a community of traders who value simplicity, transparency, and control.

Start your secure crypto journey today—join Digital Surge, your trusted Bitcoin exchange in Australia.

Frequently Asked Questions

How can I buy Bitcoin in Australia with Commonwealth Bank?

You can buy Bitcoin using your Commonwealth Bank account by depositing AUD into a trusted exchange like Digital Surge. With instant bank transfers and full local support, it’s a fast and secure option for Australians.

Where is the best place to buy Bitcoin in Australia?

Digital Surge is one of the best places to buy Bitcoin in Australia, offering a beginner-friendly platform, low fees, strong security, and local customer support—all fully compliant with Australian regulations.

Is Bitcoin legal in Australia?

Yes, Bitcoin is legal in Australia. It is regulated by AUSTRAC, and all exchanges like Digital Surge must comply with strict anti-money laundering and know-your-customer (KYC) laws.

How do I sell Bitcoin in Australia?

To sell Bitcoin in Australia, log into a trusted exchange like Digital Surge, convert your BTC to AUD, and withdraw funds directly to your bank account—often within minutes.

How do I trade Bitcoin in Australia?

Trading Bitcoin in Australia is simple with an exchange like Digital Surge. Create an account, deposit AUD, and start trading with access to over 300 cryptocurrencies and advanced tools.

Can I buy Bitcoin in Australia with a credit card?

Some platforms offer credit card purchases, but they often have high fees. Digital Surge supports instant bank deposits, which is a faster, more cost-effective way to buy Bitcoin in Australia.

How are Bitcoins stored?

Bitcoins are stored on the blockchain and accessed through wallets that manage your private keys. These wallets can be digital (hot wallets) or physical devices (cold wallets).

Where are Bitcoins stored?

Technically, Bitcoins aren’t stored in a single location. They exist on the decentralised blockchain, and your wallet gives you access to them via your private keys.

Where can I store my Bitcoin safely?

You can store Bitcoin safely in a secure digital wallet or a hardware wallet. Digital Surge also provides a built-in wallet with bank-grade security for everyday access and long-term storage.

Where should I store my Bitcoin?

For everyday use, a secure exchange wallet like Digital Surge’s works well. For larger holdings or long-term storage, consider a cold wallet like a Ledger or Trezor device.

DISCLAIMER: The information in this blog is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. No material contained within this website should be construed or relied upon as providing recommendations in relation to any legal or financial product.