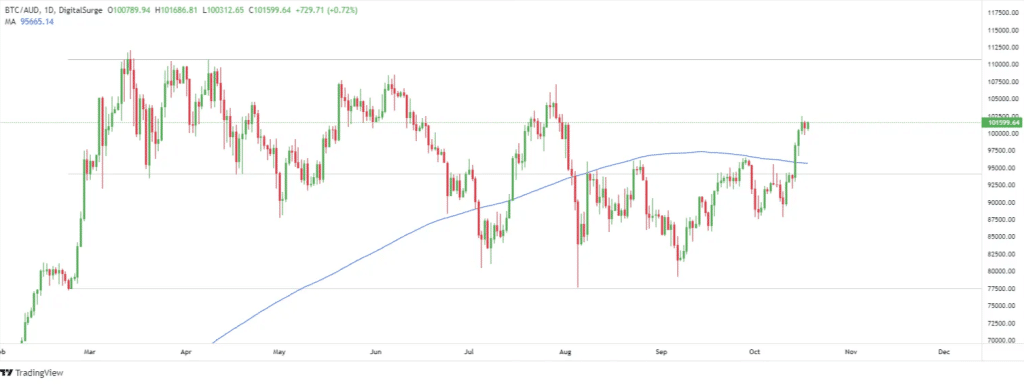

This week in crypto, Bitcoin captured attention again after reaching AUD 100,000, as it eyes a potential climb towards new all-time highs. Institutional interest continues to drive momentum, and market indicators suggest the potential for further gains as 2024 draws to a close.

Spot Bitcoin ETFs have seen significant inflows recently, indicating strong demand from institutional investors seeking regulated crypto investment products. This renewed interest highlights Bitcoin’s growing appeal as a hedge against economic uncertainty, further integrating digital assets into the broader financial landscape.

At the same time, the supply of Bitcoin on exchanges continues its year-long downtrend, reflecting a trend of long-term holding by investors. As fewer Bitcoins become available for trade, the possibility of a supply squeeze grows, which could drive prices higher if demand continues to rise.

Bitcoin is also trading above its 200-day Simple Moving Average (SMA), a critical technical level that has historically been a precursor to strong price rallies. Although previous attempts to reclaim this level didn’t trigger significant upward momentum, Bitcoin’s ability to hold above this support now has analysts predicting a potential breakout. Historically, this has led to parabolic price movements, raising hopes for a major bull run.

Despite some market concerns following Tesla’s transfer of its $765 million Bitcoin holdings to unknown wallets, the price rebounded quickly. There were initial concerns that Tesla might be preparing to sell, but no such transaction occurred, and Bitcoin’s price stability in the aftermath reassured investors.

As “Uptober” passes its halfway mark, traders are increasingly hopeful that Bitcoin will challenge new all-time highs by year’s end. The combination of rising demand for spot Bitcoin ETFs, decreasing exchange supply, and strong technical indicators points to a bullish outlook. However, macroeconomic and geopolitical risks remain, warranting caution.

Meanwhile, Elon Musk sparked excitement in the crypto space with a cryptic tweet about the “Department of Government Efficiency,” causing a surge in Dogecoin’s price. This has led to speculation about a potential memecoin supercycle, adding further intrigue to the broader market.

Other stories circulating the block:

- Grayscale files to convert its $524M multi-crypto fund into an ETF

- Monochrome launches its Ethereum backed ETF on Cboe

- Italy considers raising Bitcoin capital gains tax to 42% from 26%

- Trump’s crypto token sale linked to World Liberty Financial launches

- FBI arrests hacker for faking Bitcoin ETF approval under the SEC’s name

- Worldcoin rebrands as ‘World’ and unveils its next-gen Orb for ID verification

- U.S. spot Bitcoin ETFs see $556M in inflows, the biggest day since June

- Vitalik Buterin sells $1.6M in memecoins, donating $884K to charity

- FTX exec Ryan Salame now in prison, claims political targeting

- Mt. Gox pushes repayment deadline with 44,900 BTC unpaid

DISCLAIMER: The information in this blog is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. No material contained within this website should be construed or relied upon as providing recommendations in relation to any legal or financial product.