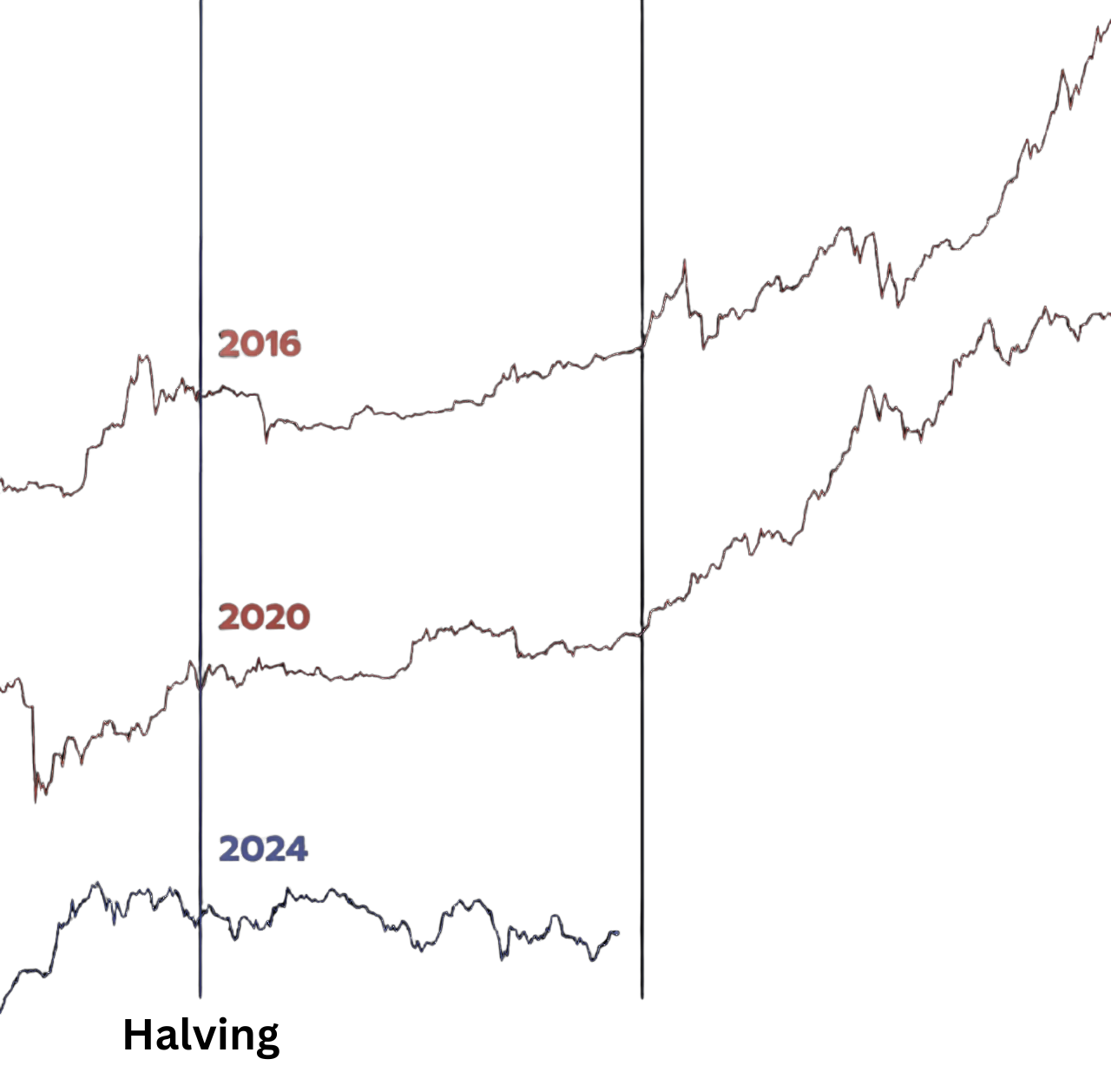

This week in crypto, the conversation surrounding Bitcoin’s 4-year cycle has reached a pivotal moment. Traditionally, the Bitcoin halving, which took place earlier this year, marks the beginning of a new bull cycle, where Bitcoin’s supply is reduced and demand pushes prices higher. Historically, the months following the halving have seen rapid growth in the crypto markets, but this year’s landscape has introduced complexities that could either strengthen or break the 4-year cycle theory.

Unlike previous cycles, 2024 saw Bitcoin reach an all-time high before the halving even occurred, largely driven by the approval of the first Bitcoin ETF earlier this year. This was a significant development, as institutional investors moved into the market, increasing demand. Now, with Bitcoin at a crucial turning point, the question remains — will the traditional 4-year cycle continue, or are we entering uncharted territory where the pattern breaks?

Adding to the intrigue, this week BlackRock revealed it is preparing for a potential $35 trillion Federal Reserve crisis. The firm is increasingly positioning itself in Bitcoin as a hedge against inflation and economic instability. According to reports, this move underscores BlackRock’s growing confidence in Bitcoin as a strategic asset capable of protecting wealth in uncertain economic times.

Some analysts point to several key events that could have a significant impact on the market. One such event is the ongoing Mt. Gox Bitcoin distribution, which has been extended to October 31, 2024. Similarly, the FTX creditor repayments are expected in late 2024 or early 2025, though it remains unclear whether this will result in renewed interest in crypto. These developments add complexity to the market outlook, with mixed potential for both bullish and bearish scenarios.

On the regulatory front, Binance CEO Changpeng Zhao (CZ) is expected to complete his jail sentence soon, which could relieve some of the pressure on Binance and the wider market. Further optimism comes from the upcoming U.S. presidential election. Historically, U.S. elections have had a substantial impact on markets, and some believe a favourable outcome could lead to a bull run for crypto.

However, not everyone is convinced that the 4-year cycle will deliver the usual post-halving rally. Macroeconomic factors are clouding the bullish outlook. Global economic conditions remain uncertain, with high inflation and tightening monetary policies across major economies. Additionally, the upcoming U.S. presidential election, while potentially bullish for some, could also bring negative regulatory scrutiny to the crypto space depending on who wins.

Another concern lies in the yen carry trade. The unwinding of this trade, which has been a key driver of global liquidity, could lead to broader market instability. This, in turn, could have a negative effect on Bitcoin and other cryptocurrencies, as liquidity dries up and investors become more risk-averse.

Despite the challenges, Bitcoin’s resilience has been noted throughout its previous cycles. Although the market has only had two full 4-year cycles to analyse, many still see the halving as a powerful catalyst for price increases. Bitcoin’s reduced supply, combined with increasing institutional interest, may well prove that the 4-year cycle can continue, even in the face of new and complex challenges.

Looking ahead, the market is at a crossroads. The combination of bullish events alongside potentially bearish macroeconomic conditions and political uncertainties, makes it difficult to predict what lies ahead. If there was ever a time for the 4-year cycle to break, it would be now — but history has shown that Bitcoin often thrives under pressure. Whether this cycle follows the patterns of the past or takes an entirely new direction, the next few months will be crucial in shaping the future of the crypto market.

More news stories circulating the block:

- Australia’s central bank launches wholesale CBDC pilot

- Brazil unfreezes Starlink, X accounts after $3M fine

- Token 2049 draws global crypto leaders to Singapore this week

- Federal Reserve cuts US interest rates for the first time since 2020

- USDC stablecoin to launch natively on Sui network

- Louisiana processes first Bitcoin Lightning payment

- Trump buys burgers with Bitcoin at NYC Bitcoin bar

- Congress accuses SEC of crypto overreach in hearing

- Circle adds Arbitrum support to its USDC platform

- WisdomTree launches self-custody platform for RWAs

- HEX founder Richard Heart faces tax evasion charges in Finland

- Infinex NFTs top $40M in sales despite NFT bear market

- Bitget and Foresight Ventures invest $30M in TON

- BitGo introduces USDS stablecoin with user rewards

- Banana Gun bot users lose $1.9M in major exploit

- Tether’s USDT on TON chain surpasses $1B in value

- Bhutan holds more Bitcoin than El Salvador

DISCLAIMER: The information in this blog is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. No material contained within this website should be construed or relied upon as providing recommendations in relation to any legal or financial product.